Step 1 - Get Ready for Home Ownership

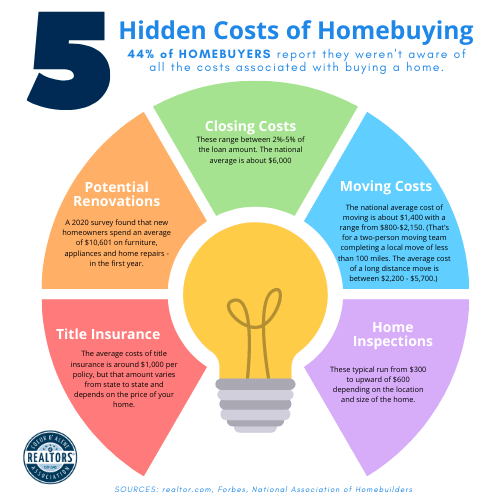

Build good credit history, get mortgage pre-approval and find out what type or mortgages you qualify for. Save up for a down payment and closing costs.

Step 2 - Find a REALTOR®

Get a referral from friends, family and work colleagues, or use CCR's Find a Realtor® resource for a Realtor® who serves your needs. Interview with several Realtors® to find the best match.

Step 3 - Find the Right Property

Determine what is important for you, such as transportation, schools, neighborhood amenities, monthly payments, etc.

Step 4 - Find the Right Financing

Narrow down your search to a few mortgage brokers or lenders. Make sure you understand the financing terms: ask the lender for clarification, if needed, and select the right loan program.

Step 5 - Make an Offer

Ensure the property is inspected by a licensed home inspector and acquire title insurance. Make sure to read all contracts fully before signing anything, and ask questions if you do not understand something. Place a competitive bid and prepare for a counter-offer. Only one offer will get the sale, so be prepared to move on if you do not win the bid.

Step 5 - Closing and Life After the Big Sale

Protect your new asset by obtaining owner's title insurance. Perform maintenance and repairs on your new home. Keep good records of all warranties and documents used in the home-buying transaction. Set up utility bills in your name, and make sure to maintain your files. Hire movers or find a few friends for a moving party! Find a service provider through CCR's Community Partners database.